Material and Shipping Costs

May 1, 2021

Background

Along with all other US manufacturers who import parts from China, we were hit with a 25% part-cost increase due to the tariffs placed on Chinese imports back in 2018. This was particularly significant for WAZER, since we did not account for this unexpected cost when we launched the Kickstarter crowdfunding campaign in 2016. So we had no choice but to absorb this cost when we started producing the waterjet machines in 2018, because we had already pre-sold these units two years prior. Now, three years later, in 2021, we are dealing with yet another increase in supplier costs due to pandemic-induced widespread supply chain shortages. The magnitude of this price increase is greater than in 2018. We are experiencing 6 months of steady material and part cost increases as well as 13 months of steady shipping container price increases.

Material Costs

During our September 2020 manufacturing batch of parts we started to see a few raw materials and parts creep up in costs. We didn’t think too much of it at the time and decided to just keep a watchful eye on things throughout the following months. By late 2020 we saw that this was just the beginning of a much larger trend in the global supply chain, and we were about to be in for a ride up. By April 2021 over 50 different parts were meaningfully affected by price increases (greater than 10%). Some of the more substantial ones include:

Wire Harnesses were up over 15% due to the increases in copper material and certain connectors

Motors up 20% due to material cost increases in copper, steel, and aluminum.

Dozens of custom sheet metal, extruded, and machined parts are up 9-15% due to increases in material costs for aluminum, mild steel, and stainless.

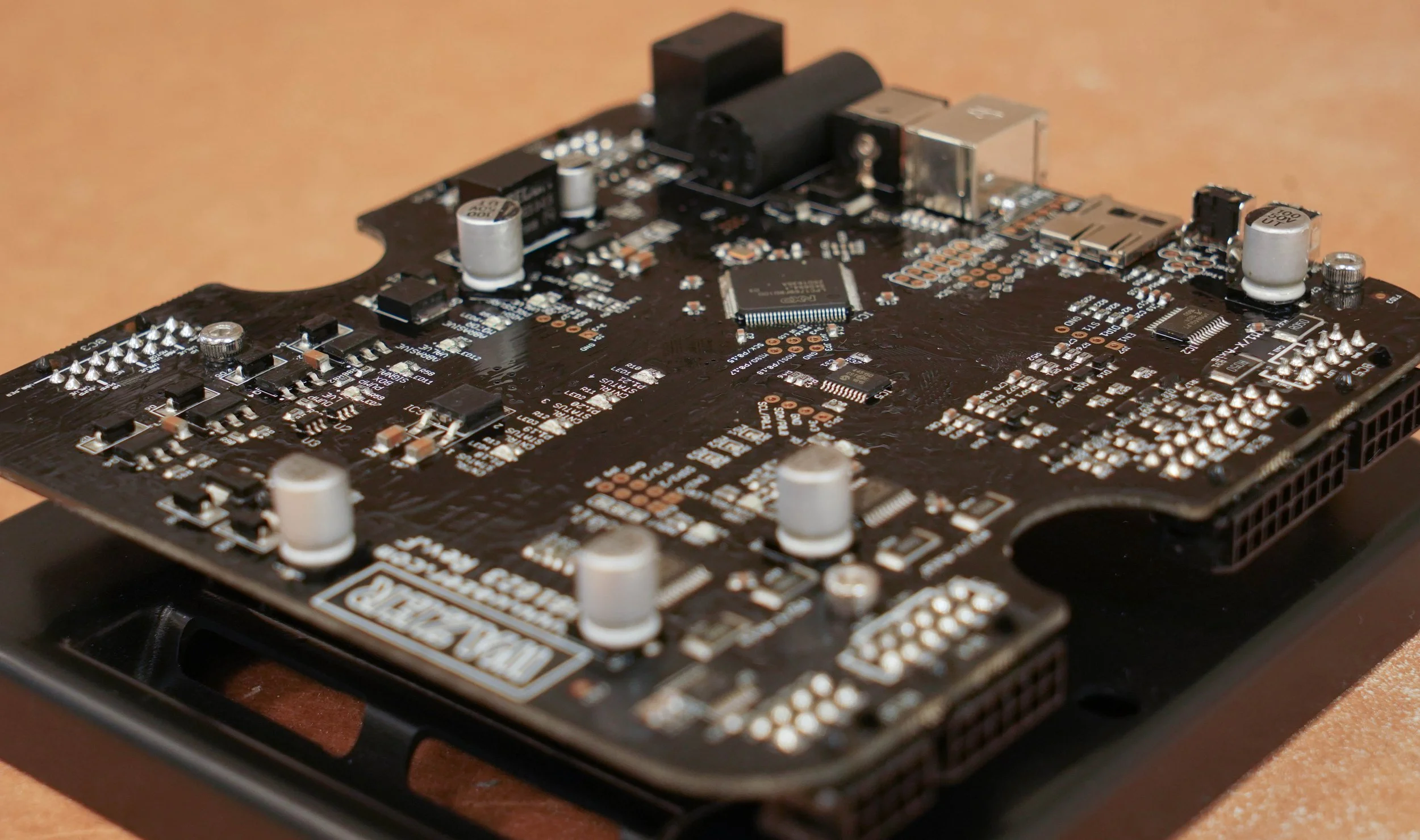

PCB costs are up almost 10%

Furthermore, the integrated circuit (“chip”) shortages have left us paying a 1000% premium for certain components (the three zeros aren’t a typo!). This is in order to make sure we could attain the chips that we need to continue producing machines well into 2022 without interruption. Thankfully the buffers and reserves that we had to de-risk component shortages on critical parts for a few months covered about half the 52 week lead time that is now the norm across the industry. Given the nimbleness of our design and manufacturing teams, we also decided to replace some of the costly components with new, leaner circuit designs instead of paying premiums for the grey market parts.

In most cases material cost increases are the result of shortages. We talked about material and part shortages in January, and we are continuing to fight this battle. We are spending significant time every week trying to understand the situation at hand and speculate about what the situation will be far off in the future for the parts, materials, and supplies we need. We typically operate with buffers of 3-6 months on parts, however with no end in sight for these shortages, we are looking ahead 6-10 months on certain critical components. This is additional overhead our sourcing and procurement teams are taking on both in China and the US. While it’s not necessarily something we want to be devoting resources to at the expense of other progress within the company, it is definitely critical given the ongoing global supply chain issues.

Shipping

Every WAZER has over 400 parts, weighs hundreds of pounds, and takes up 60 cubic feet of volume. All of these parts and subassemblies need to be shipped from our Shenzhen, China facility to our US Headquarters via sea freight, which is a meaningful portion of the cost of producing a WAZER machine. With container shortages hitting all time highs, so too have prices, and every WAZER machine we produce costs us that much more. How much more you may ask? Container fees alone have risen over 400% from pre-pandemic levels.

The China Team always ships full container loads of well organized parts and subassemblies in the correct quantities to the US Team every few weeks. Seeing the costs ballooning, we have invested in redesigning how we package and ship some of our large parts from China in order to get more machines onto every container. Running pretty dense already, we haven’t been able to make a significant dent in the 400% price hike but have increased our packing densities by about 5% to allow for one additional pallet of goods to be transferred to the US with every container load.

Assembly

As a part of our internal WAZER continuous improvement programs, we invest time and money to reduce cost through design and production line efficiencies that decrease assembly times. Originally this large investment for us was justified from a business standpoint in order to bring the price point down to make the product more accessible to our customers. And we’ll be honest here…the other reason is to let our engineers and operators scratch that itch and have some fun in making something better and more efficient in the company :). These improvements have offset some of the cost increase that we’ve been experiencing.

Conclusions

We are always up for a challenge at WAZER and, despite these cost increases, we will continue to do our best to maintain our current pricing for as long as possible. We are particularly well positioned to keep costs low because of how vertically integrated we are with our supply chain. With that said we can only absorb price increases for so long, and we hope that things turn around or at least level off soon. WAZER’s overall goal is to democratize manufacturing, and we want to make the technology accessible to as many small manufacturers as possible